Bank of England purchases long-term bonds

- In order to ease the market turmoil brought on by the incoming government’s so-called mini-budget, the Bank of England will postpone starting its planned gilt sale next week and start temporarily purchasing long-dated bonds.

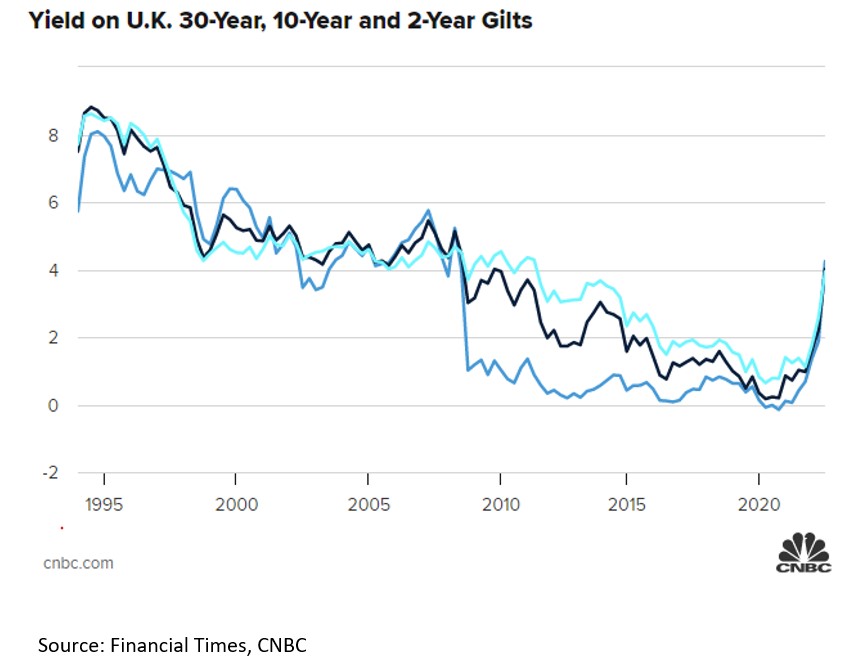

- As investors fled British fixed income markets in the wake of the new fiscal policy announcements, yields on U.K. government bonds, also known as « gilts”, were on track for their biggest monthly increase since 1957.

- On Wednesday, the Bank’s Financial Policy Committee decided to take immediate action after acknowledging that the malfunction in the gilt market constituted a significant risk to the nation’s financial stability, as financing conditions would become tougher and the amount of credit flowing into the real economy would decrease.

- The first gilt sales, originally scheduled for Monday, will now take place on October 31st in accordance with the Monetary Policy Committee’s aim of a yearly £80 billion ($85 billion) decrease of its holdings of gilts, according to the bank.