Retail investors seeking refuge in Cash

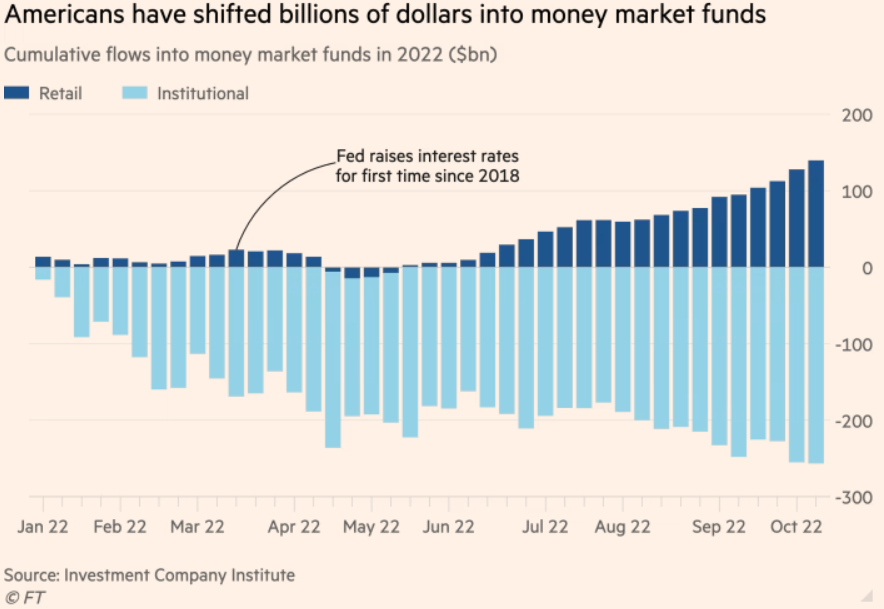

- After this year’s severe financial market sell-off, which resulted in trillions of dollars in losses and stifled excitement for riskier assets, retail investors are accumulating cash. According to the Investment Company Institute, retail money market funds have received about $140 billion so far in 2022, increasing their size to $1.55 trillion. Investor and consumer confidence have been severely impacted by the market turbulence, which is being fueled by soaring inflation and rising borrowing prices as the Federal Reserve tightens up on monetary policy.

- How is this cash being invested? Money market funds have gradually switched into investments with shorter maturities since the year began, with many using the Fed’s overnight reverse repo facility, a program that is exclusively available to certain banks and asset managers. As a result, the funds are now able to benefit from higher rates as soon as the central bank raises borrowing rates.

- Investors predicted that the Fed’s monetary policy as well as general market volatility would influence people’s need for cash. Some sounded the alarm that cash might become less alluring if and when the Fed deems that it has a handle on inflation

Source: Financial Times, Investment Company Institute