After a year and a half of post-covid era, it seems like we are getting, slowly but surely, back to a certain normality where, even though masks are still the norm, you can start to take them off, travel is reviving, and curfews seem to be a nightmare of the past.

This return to normality also applies to finance and economics. Economies in the Eurozone are recovering from the hit they took in March of 2020 and the ECB has hinted towards a slow-down and eventual stop to the Pandemic Emergency Purchase Programme (PEPP) they started at the beginning of the pandemic.

What is the Pandemic Emergency Purchase Programme (PEPP)?

The PEPP is a non-standard monetary policy measure that started in March 2020 with the covid outbreak to counter the risks to the monetary policy and the outlook for the euro area economies posed by the pandemic.

It is a temporary Asset Purchase Programme (APP) of private and public sector securities intended to indirectly alter the private sector’s borrowing and spending behavior as well as addressing possible liquidity issues that could arise. All the asset classes eligible under the APP were also eligible under the PEPP. In addition, it includes a waiver of the eligibility requirements for securities issued by the Greek Government. The minimum eligible remaining maturity was shortened to 70 days, while the maximum eligible remaining maturity for public sector asset purchases is set at 30 years and 364 days. Furthermore, the eligibility of non-financial commercial paper under the Corporate Sector Purchase Programme (CSPP) was expanded to include securities with a remaining maturity of at least 28 days.

Initially the PEPP was going to have €750bn for these purchases. However, on the 4th of June 2020, the Governing Council decided to increase an extra €600bn and then on the 10th of December 2020, another €500bn. The total sum of the PEPP would end up amounting to €1.850bn.

The duration of the PEPP was specified at the beginning, with the ECB stating the following: “the Governing Council will terminate net asset purchases under the PEPP once it judges that the COVID-19 crisis phase is over, but in any case, not before the end of March 2022”.

Financial background and what did the PEPP imply?

The ECB was already carrying out a Quantitative Easing (QE) strategy when the COVID-19 outbreak happened. This QE program started in March 2015 and its main purpose was to prevent sub-zero inflation in the Eurozone at a time where economies were still recovering from the eurozone debt crisis. In this QE program, the ECB bought government and corporate debt, asset-backed securities, and covered bonds at a pace of €1,3 million a minute.

By mid-late 2019 the QE program was stabilized, and the balance sheet of the ECB was not increasing, but rather staying constant (see chart below). What the PEPP implied was a sudden resumption and increase in the QE program. As it can be observed in the chart, the slope at which the Balance Sheet of the ECB – which consists of all the bonds, corporate debt, asset-backed securities, and other financial assets – increased was something never seen before. In fact, in a year’s time the Balance Sheet of the ECB has nearly doubled, currently amounting to €8.191bn.

How does the PEPP work?

PEPP helps people and firms get access to affordable funds they need to weather the crisis and is a complement to the other monetary policy measures already in place.

The PEPP allows the ECB to purchase the assets above-mentioned in the financial markets, making their prices go up and implicitly, the market interest rate go down. This makes borrowing cheaper for companies, governments and individuals. It is an expansive policy that helps maintain borrowing, spending and investing stable despite the pandemic crisis.

In addition, the PEPP seeks to boost economic growth and inflation through incentivizing consumption and investment, and ultimately, reactivating the economy.

It is worth remarking that the PEPP, although similar to the regular Asset Purchase Programme (APP), has some unique characteristics. These are:

It is flexible. In what kind of assets they buy, when they buy it and in which countries. This allows the ECB to respond rapidly to changes in the financial or economic environment to preserve the best financing conditions.

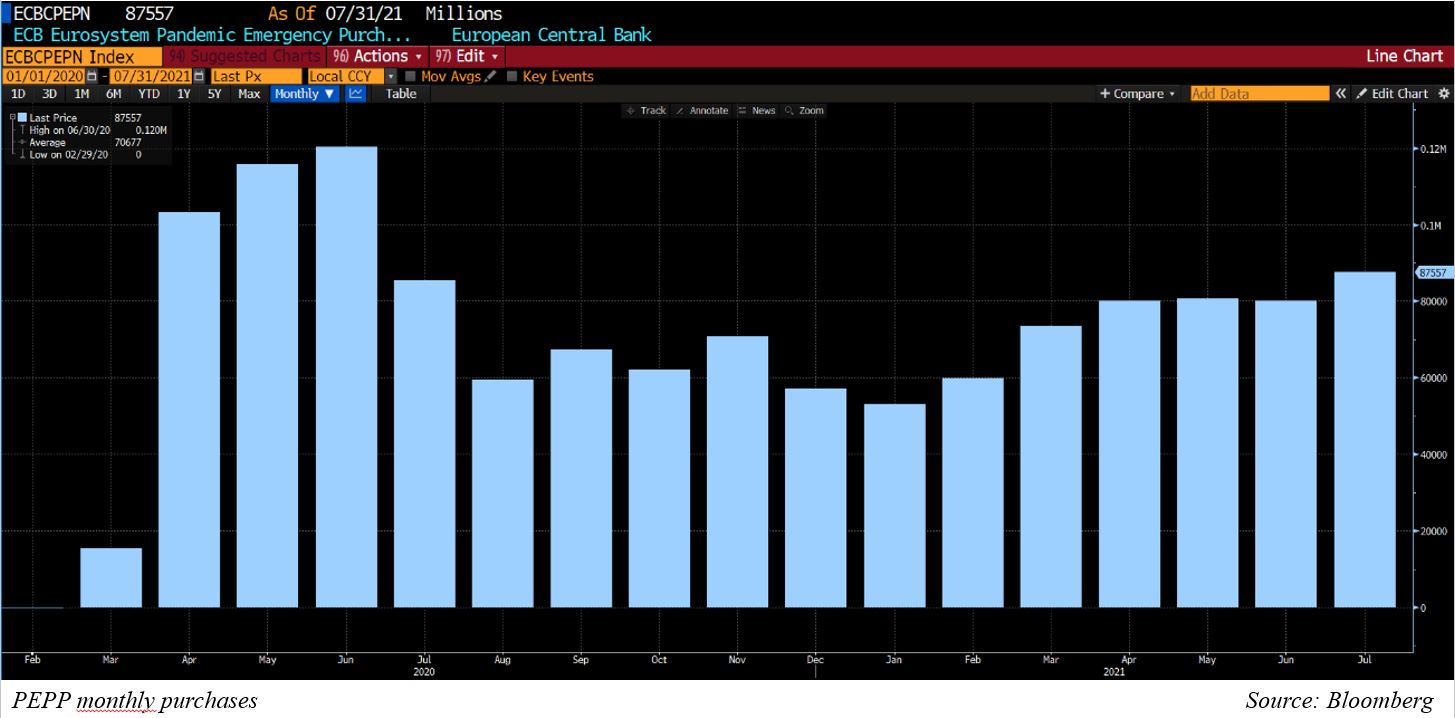

As it can be seen in the graph above, the pace of the programme has stabilized around the €80bn mark over the last months. However, the amount they disbursed each month has been varying throughout the period analyzed. This has enabled the BCE to keep optimal financing conditions through one of the worst crises the Euro area has faced.

It is scalable. The initial allocation was €750bn and has been bumped up to €1.850bn. This amount can be raised or lowered as required to maintain favorable financing conditions.

Roughly €1.350bn have been deployed so far. Thus, unless the programme is cut short, they still can purchase assets worth €500bn.

It is temporary. It is specifically created to counter the impact of the coronavirus crisis on the eurozone and will be carried out until, at least, March 2022 or until the Governing Council judges that the crisis is over.

What has been the result of the Programme so far?

The PEPP Programme has boosted the region’s bond markets, helping to keep yields close to all-time lows even as governments issued record quantities of debt to navigate the pandemic crisis.

The economies in the eurozone have been able to weather the storm thanks to this “life-support” system for the economies and markets that the PEPP has been. Economies were able to recover in a V-shape and consumption was rapidly reactivated thanks to the lax monetary policy coupled with the PEPP, which incentivized financial players to borrow and lend.

However, this also comes at a cost, the Balance Sheet of the ECB expressed as a percent of the Eurozone GDP has skyrocketed, reaching 70% in the last August’s reading.

What to expect next?

A year and a half after the start of the pandemic and the PEPP, economies are experiencing record GDP growth rates, falling unemployment figures, and record inflation figures. All these figures point towards one direction; it might be time to start thinking about slowing down – and eventually stopping – the PEPP Programme.

Over the last week, Francois Villeroy (Governor of the Bank of France) has hinted that, given that the evolution of the markets is better than expected, and in order to preserve optimal financing conditions and to contain inflation, a reduction in the pace of asset purchases of the PEPP might be possible in the coming months.

Does this mean that the PEPP will come to a halt in Q4 of 2021? No, this means that the monthly purchases of €80bn might be trimmed. The end of the Programme is yet to be discussed based on the further evolution of the markets and economies in the Eurozone. However, this tapering will be a dovish one, as they remain flexible to increase the pace if financing conditions tighten again and monetary policies will remain accommodative even after the PEPP ends next year. It is worth remembering that the PEPP is running parallel to the APP that was being already carried out in the QE program of the ECB. Thus, even after the PEPP is over next year, the APP will continue to run at its normal pace.

How have the markets reacted and how will they react going forward?

At the time of writing of this article, investors in the eurozone have reacted to this news by pricing in some risk of a taper in the September meeting of the ECB. Germany’s 10-year bond yield rose to minus 0.36%, up from minus 0.5% two weeks ago, reflecting a drop in prices. The yield on Italy’s benchmark bonds rose to 0.712% from its low last month of 0.513%. Experts say that there is room for a further sell-off, but the spread between the German and Italian borrowing costs has widened only so slightly. This is, there are no signs of mounting pressure in more indebted nations.

As for what will happen going forward, that is a great question for which there is no clear answer. Markets are unpredictable -specially under the current circumstances – and the reaction to the slow-down and eventual stop of the PEPP is yet unknown. That is why the ECB wants to make this process as slow and smooth as possible, so markets have time to digest the news without major hiccups.

Article by: Alexandro López Rodríguez

Fuentes: ECB, Bloomberg, Reuters, Financial Times, elEconomista, Investing