New Momentum Advisory

A team of dedicated experts for all your corporate financial projects

How DO We Proceed

New Momentum Advisory offers a wide range of services in order to provide optimal answers to financial problematics. Each mission is led by experienced professionals, giving you access to the best possible solutions every time. We created New Momentum Advisory as a complement to the Investment Department to offer the most complete and integral solutions.

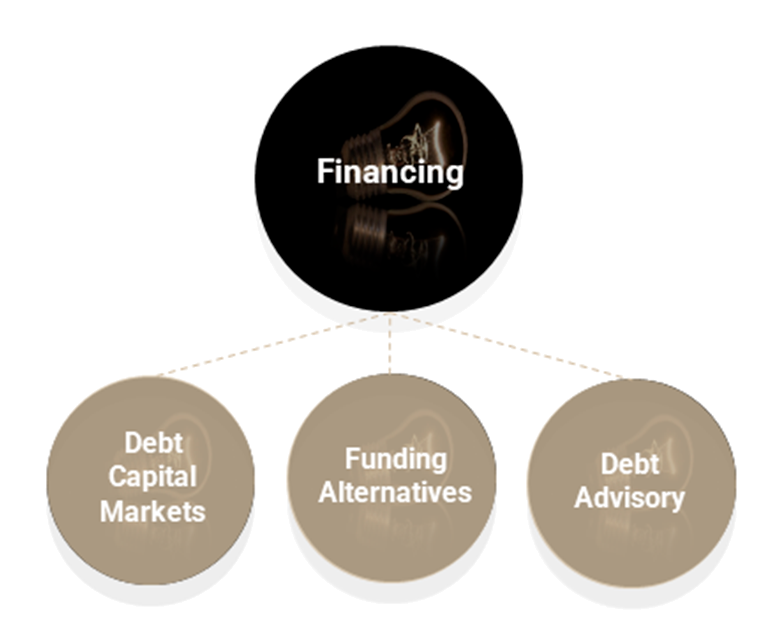

Debt Capital Market

We give you access to the most efficient Marketplaces in Europe to diversify your investor base in terms of geography, sector and maturity (long and short term).

Funding Alternatives

Alternative financing solutions adapted to your business model.

Debt Advisory

Independent intermediary benefiting from its privileged relationship with debt providers, delivering:

- Debt management

- Negotiations with banks

- Maturity extension

- Rating advisory

Back Office Support

Assisting you all along the Settlement Processes.

FX & Rates Hedging

Active risk management in the Foreign Exchange and Interest Rates markets.

Market Analysis & Pricing

A resource to identify Market Risks and Opportunities and optimising your costs.

Debt Structuring Advisory:

Analyse your company financials, structure and needs.

Assessment of your company’s credit risk positioning with banks, rating agencies and investors.

Assessment of current bank pool and evaluation of opportunities for optimization.

Types of Financing we can help you set-up:

Syndicated bank loans, club deals, or bilateral loans.

Factoring and reverse factoring.

Securitization

Commodity/Trade Finance

Finance Leasing

Bank Guarantees

Structured financing

Direct Debt (Direct Lending, Mezzanine, etc.)

Besides its proven track record in Capital Markets Advisory, New Momentum has a large experience in Debt Structuring and Restructuring through banks or alternative providers.

New Momentum intervenes as an expert and advisor, in a totally independent way, complying with the client’s instructions in order to reach its objectives.

Setup

We use our extensive knowledge of the markets to help you design a program centered around your objectives.

Registration

Our status of Registered Advisor allows us to accompany throughout the registration process.

Issue

We apply our knowledge and relations within the Debt Capital Markets participants to help you achieve your goals.

Placement

New Momentum is licensed to place fixed income securities.

Benefits of DCMs:

Lower Cost of Financing

Increase visibility and credibility

Diversify Investor base (geography, sector)

Increase liquidity and flexibility (maturities, amounts, prices)

Our mission

New Momentum has quickly become a key partner for its corporate clients who require knowledge of financial products and in particular of short and medium-term financing solutions. Thanks to this experience, New Momentum can advise them on the next stages:

Market Monitoring

Analysis, evolution and trend of the debt markets. Impact of regulations, comparison with other European countries.

The program

Program size, comparison with similar debt issues, market analysis.

Registered Advisor

Drafting of the issue prospectus and relationship with the chosen market.

Assistance in the different application processes.

Paying Agent

Drafting of the tender for the search of a domiciliary agent, advice on the choice of this agent, drafting of the contract binding the issuer to the agent.

Rating Advisory

Whether or not it is necessary for the program to be rated by a rating agency, with an impact on the issue price and/or issuance capacity.

Placing Agent

New Momentum as placing agent and/or drafting of the invitation to tender for the search for other agents, advice on the choice of these agents, drafting of the contract between the issuer and the agents.

We wanted to provide our clients access to knowledge acquired over many years in the trading rooms of the most important international banks, assisting companies in terms of currency hedging, rate optimisation and cash management.

New Momentum is your outsourced trading room designed to cover all your financial services.

Back office support

- Checking the market price

- Settlement Process

- Order tracking

- Confirmation and correction of the transactions processed.

- Management of MIFID Regulations

Market analysis

- Technical analysis of a market and its actors

- Trend and Forecast Analysis.

- Economic and Financial Research

- Due Diligence

- Costs of Financing

- Cash management solutions

FX and Rates Hedging

- Evaluation and Optimization of the risk of your existing positions

- Detection of opportunities to restructure existing positions fitting better to new market conditions

How do we manage your risks?

Comprehensive and Efficient Tools

Based on the experience we have acquired in the trading rooms, we have developed our own internal risk management tool. This tool has proven to be a complete and technical ally allowing us to manage your exposure to currencies, interest rates, equities or commodities in a synthetic manner.

A Global Vision

Our international team and our tools have enabled us to acquire a global vision of the composition of our clients’ portfolios, in terms of both products or assets. This allows us to anticipate market movements in order to help our clients focus on their business and optimise their cash flows.

One Objective: Take the Most Efficient Decisions

The objective of our internal tools is to provide all the necessary information to manage our clients’ risk: Mark-to-market of the open positions, levels of coverage reached, global budget, total delta of the positions, etc.

Combined with an in depth analysis from our team of experts, this allows us to detect the most efficient hedges.